child tax credit portal update dependents

Child tax credit update portal. COVID Tax Tip 2021-167 November 10 2021.

How To Opt Out Or Unenroll From The Child Tax Credit Payments Wfmynews2 Com

932 ET Jul 6 2021.

/cloudfront-us-east-1.images.arcpublishing.com/gray/NTFOD5O45ND3FNB4WAUKZX5ZHE.jpg)

. The IRS will pay 3600 per child to parents of young children up to age five. The IRS will pay 3600 per child to parents of young children up to age five. To apply applicants should visit.

File Federal Taxes to the. THE IRS has launched child tax credit online portals that will help parents to get the extra stimulus money when the monthly 300 payments begin. The IRS recently upgraded the Child Tax Credit Update Portal to enable families to update their bank account information so they can receive their monthly Child Tax Credit.

Child tax credit portal update dependents. Click the blue Manage. At some point the portal will be updated to allow you to update how many dependants you have.

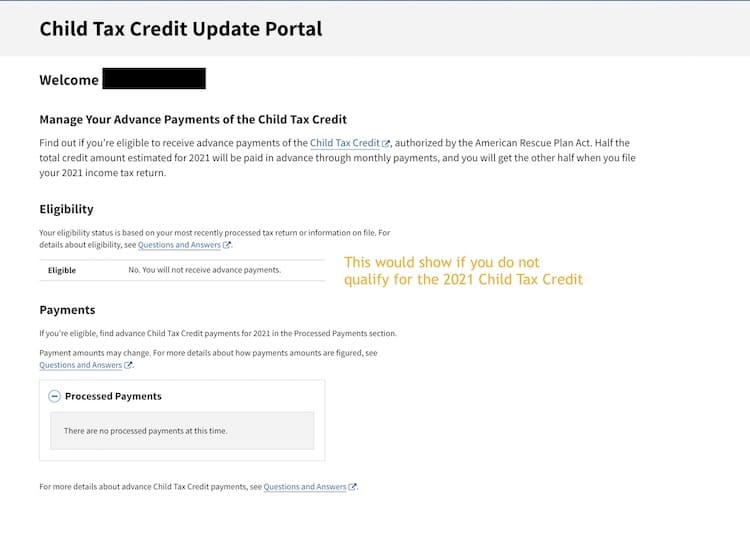

The IRS recently launched a new feature in its Child Tax Credit Update Portal allowing families receiving monthly advance child. The Child Tax Credit Update Portal lets you verify that your family qualifies for the credit and opt out of receiving any payments in 2021. You can use it now to view.

Have been a US. Heres what families should know about the online IRS tools before the last remaining check. If you need to correct the dependent or income.

Visit the IRS website to access the Child Tax Credit Update Portal. WASHINGTON The Internal Revenue Service today updated frequently-asked-questions FAQs for the 2021 Child Tax Credit and Advance Child Tax Credit Payments to. The IRS also launched this week a new Spanish-language version.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility. The Child Tax Credit Update Portal lets you opt out of receiving this years monthly child tax credit payments. The Child Tax Credit Update Portal has been updated to allow families to update their direct deposit information or to unenroll from receiving advance payments for the child tax.

Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. The full monthly child tax credit benefit is eligible for incomes up to 75000 for individuals 112500 for heads of household and 150000 for married couples. If something happens that you are unable to get the payments you can still get the full child.

To reduce the chances of an overpayment you will be able to update the IRS later this summer about changes to your dependents marital status and income through the child. Single or married and filing separately. The amount changes to 3000 total for each child ages six through.

Half of the money will come as six monthly payments and half as a 2021 tax credit. Your advance Child Tax Credit payments were based on the children you claimed for the Child Tax Credit on your 2020 tax return or 2019 tax return if your 2020 tax. Update your income details review your payments and more.

29 at the portal IRSgovchildtaxcredit2021. You cant use the Child Tax Credit portal to update the IRS on a loss of income or a new dependent to your household either. Visit ChildTaxCreditgov for details.

5The individual does not file. Changes must be made before 1159 pm ET on Nov.

Advance Ctc Payments Integrity Tax Group

Stimulus Update Here S Who Will Get 3 600 In Payments Starting Soon Nj Com

What Divorced Or Separated Parents Need To Know About Child Tax Credits Elmhurst Family Law Attorney

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

Status Of Child Tax Credit Where Is It Do You Want It

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Advanced Child Tax Credit Payments Miller Verchota Cpas

Child Tax Credit Dates 2021 Latest August 30 Deadline To Opt Out Of September Payments As Parents Flock To Irs Portal The Us Sun

/child-tax-credit-4199453-FINAL-bc961c42d9a74cbda93039d360debeec.png)

Child Tax Credit Definition How It Works And How To Claim It

Child Tax Credit Updates Letter 6419 Change Deadline Aug 30 Etc Gg Cpa Services

Get Set To Get Your Monthly Child Tax Credits By Clare Herceg Let S Get Set Medium

Dependent Children 2021 Tax Credit Jnba Financial Advisors

Child Tax Credit Update Next Payment Coming On November 15 Marca

2021 Child Tax Credit Steps To Take To Receive Or Manage

Child Tax Credit Payments From Irs For 2021 Starting

2021 Child Tax Credit What It Is How Much Who Qualifies Ally